Aggressive Allocation funds allocate a minimum of 75-80% of their investments in equities, with the remaining portion invested in debt instruments. This strategy enables investors to benefit from the strengths of both asset classes within a single fund.

3+ years

30 Funds

₹2,28,993 Cr Total AUM

Sort By

| Fund name | Fund size | Expense Ratio | 3Y Returns |

|---|---|---|---|

JM Equity Hybrid Fund Direct Growth Aggressive Allocation Very High Risk | ₹642 Cr | 0.56% | 23.0% |

ICICI Prudential Equity & Debt Fund Direct Growth Aggressive Allocation Very High Risk | ₹41,395 Cr | 0.98% | 20.3% |

Bank of India Mid & Small Cap Equity & Debt Direct Growth Aggressive Allocation Very High Risk | ₹1,000 Cr | 0.95% | 19.8% |

Edelweiss Aggressive Hybrid Fund Direct Growth Aggressive Allocation Very High Risk | ₹2,197 Cr | 0.41% | 19.5% |

Quant Absolute Fund Direct Growth Aggressive Allocation Very High Risk | ₹2,352 Cr | 0.7% | 17.9% |

Mahindra Manulife Aggressive Hybrid Fund Direct Growth Aggressive Allocation Very High Risk | ₹1,487 Cr | 0.46% | 17.7% |

UTI Hybrid Equity Fund Direct Growth Aggressive Allocation Very High Risk | ₹6,330 Cr | 1.24% | 17.0% |

Invesco India Equity & Bond Fund Direct Growth Aggressive Allocation Very High Risk | ₹545 Cr | 0.84% | 17.0% |

Kotak Equity Hybrid Fund Direct Growth Aggressive Allocation Very High Risk | ₹6,714 Cr | 0.45% | 16.8% |

Nippon India Equity Hybrid Fund Direct Growth Aggressive Allocation Very High Risk | ₹3,975 Cr | 1.14% | 16.4% |

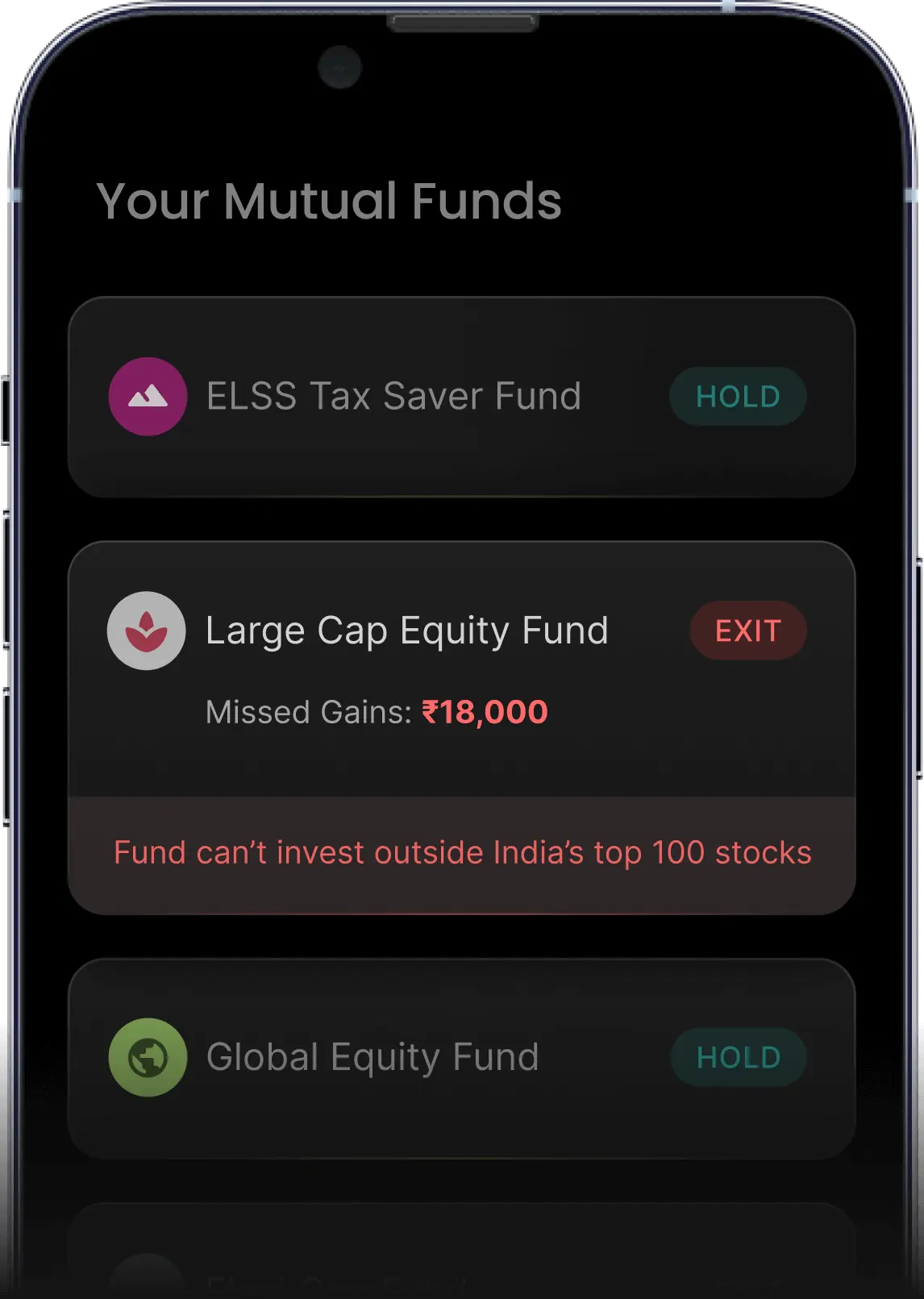

Identify red flags in your mutual funds and how to fix them

The SEBI (Securities and Exchange Board of India) has defined aggressive hybrid funds as those with 65-80% exposure to equity and equity related instruments and 20-35% to debt instruments.

As per AMFI (Association of Mutual Funds in India), as of July 2023, there are 30 aggressive hybrid fund schemes offered by AMCs (Asset Management Companies). The 30 schemes manage around Rs. 1,70,000 crore worth of investor assets.

Aggressive hybrid funds can have several benefits depending on your use case. Here are some of the major benefits:

Different macroeconomic situations help different asset classes (like equity and debt) perform better/worse.

If the fund manager of an aggressive hybrid scheme feels that equity is unlikely to perform well in the future, they can reduce the equity allocation to 65%.

On the other hand, if they feel that equity is likely to generate good returns in the future, they can increase the equity allocation to 80%.

This flexibility gives the fund manager a role to play in the asset allocation which, if they get right, can result in higher returns for you.

The 20-35% debt allocation in aggressive hybrid funds helps them survive market volatility and crashes.

Suppose there’s a pure equity fund (PEF) with 100% allocation to a portfolio of stocks. There are two aggressive hybrid funds (AHF-1, AHF-2) with 80% and 65% allocation to the same portfolio of stocks and the remaining 20% and 35% allocation to a portfolio of debt securities.

Let’s assume that you have invested Rs. 1,00,000 in each of the 3 funds described above.

If the portfolio of stocks experiences a 50% crash due to a macroeconomic event, here is what will happen to your investments in the 3 funds:

| Investment amount: Rs. 1,00,000 each | |||

| Fund | Equity allocation | Debt allocation | Value after 50% crash |

| PEF | 100% | 0% | Rs. 50,000 |

| AHF - 1 | 80% | 20% | Rs. 60,000 |

| AHF - 2 | 65% | 35% | Rs. 72,500 |

As you can see, the debt component (assumed to have experienced neither gain nor loss during the equity market crash) in the aggressive hybrid funds help reduce your notional loss.

The capital gains tax rate is fixed for equity instruments like stocks and equity oriented mutual funds.

It is 15% for gains booked within 1 year of investing, also known as short-term gains; 10% for gains booked after 1 year of investing, also known as long-term capital gains. This also the capital gain taxation applicable to aggressive hybrid funds since they are equity oriented mutual funds.

On the other hand, capital gains taxation from debt instruments like debt mutual funds and fixed deposits are taxed at your marginal tax rate.

If you are in the higher tax brackets (20% and above), then your aggressive hybrid funds will be taxed at the equity taxation. This works in your favour because the debt component (25-40%) would have attracted a higher taxation rate had you invested in it directly or through some debt mutual fund scheme(s).

Illustration:

Let’s assume that you are in the 30% tax bracket (let’s ignore cess, surcharge etc. for simplicity’s sake). You have two investment options:

Here are how you will be taxed for in each case:

| Instrument/portfolio | Taxation for periods <1 year | Taxation for periods >1 year |

| Aggressive hybrid funds | 15% | 10% |

70% equity schemes + 30% debt schemes | 19.5%$ | 16%# |

| Difference | 4.5% | 6% |

$ Calculated as 70% * 15% + 30% * 30%

# Calculated as 70% * 10% + 30% * 30%

The taxation is even more favourable for aggressive hybrid funds when we consider that capital gains of Rs. 1 Lakh per financial year for periods >1 year is exempt from tax.

Aggressive hybrid funds take exposure to equity as well as debt instruments. Both the instruments are exposed to different types of risks.

Equities are exposed to market risk, currency risk, commodity risk etc. Debt instruments, on the other hand, are exposed to credit default risk, interest rate risk, liquidity risk etc.

Pure equity or pure debt funds would have been exposed to just one set of risks but hybrid funds are exposed to 2 sets of risks.

This makes the job of the aggressive hybrid fund manager more difficult as he has to navigate several different types of risks.

Most aggressive hybrid funds are a mix of large cap funds and corporate bond funds. But the expense ratio of aggressive hybrid funds is higher than a portfolio mix of large cap and corporate bond funds.

To be able to make a comparison, let’s assume that aggressive hybrid funds target to have a 70% equity and 30% debt allocations at all times. We can compare this with mutual fund portfolios that can be as close to an aggressive hybrid fund as possible.

| Instrument/portfolio | Average expense ratio% |

| Aggressive hybrid funds | 0.95% |

70% equity large cap active funds + 30% corporate bond funds | 0.72% |

70% equity large cap index funds + 30% corporate bond funds | 0.32%# |

70% equity large and mid cap funds + 30 corporate bond funds | 0.67% |

%Direct plans of all active open-ended schemes considered as of Aug 2023

#Assumed average expense ratio of large cap index funds is 0.3%

Dezerv internal research

As you can see, aggressive hybrid funds have a considerably higher average expense ratio than a mix of 70% equity funds and 30% corporate bond funds.

Well, it depends. The best person to answer this question is a financial advisor who has spent time understanding your financial goals and risk profile.

However, here are some situations where you can consider aggressive hybrid funds:

Note: The above information is for educational purposes only. It is best to consult a financial advisor before making investment decisions.

Aggressive hybrid funds are those that invest 65-80% of your money in equity instruments and 20-35% in debt instruments.

Aggressive hybrid funds are equity oriented funds and taxed accordingly. Short term gains (gains realised within 1 year of investing) are taxed at 15% whereas long term gains (gains realised after 1 year of investing) are taxed at 10%. Investors enjoy an exemption of up to Rs. 1 lakh per year on your long term capital gains.

For the 1-year period ending 30 Aug 2023, the average 1-year return of direct plans of active aggressive hybrid funds is 13.6%.

By Equity-Debt Allocation

By Solutions

Others

Equity funds mainly invest in stocks of different companies, making investors partial owners of those companies when they invest in such funds.

Debt Mutual Funds invest in fixed-income securities such as government bonds, corporate bonds, treasury bills, and other money market instruments.