Index mutual funds invest in stocks that mirror popular stock market indices such as NSE Nifty and BSE Sensex.

5 years+

155 Funds

₹1,28,562 Cr Total AUM

Sort By

| Fund name | Fund size | Expense Ratio | 3Y Returns |

|---|---|---|---|

Motilal Oswal Nifty Smallcap 250 Index Fund Direct Growth Index Funds Very High Risk | ₹828 Cr | 0.36% | 23.2% |

Aditya Birla Sun Life Nifty Midcap 150 Index Fund Direct Growth Index Funds Very High Risk | ₹293 Cr | 0.44% | 23.1% |

Nippon India Nifty Smallcap 250 Index Fund Direct Growth Index Funds Very High Risk | ₹1,873 Cr | 0.35% | 23.1% |

Motilal Oswal Nifty Midcap 150 Index Fund Direct Growth Index Funds Very High Risk | ₹1,949 Cr | 0.3% | 23.1% |

Nippon India Nifty Midcap 150 Index Fund Direct Growth Index Funds Very High Risk | ₹1,638 Cr | 0.3% | 22.8% |

UTI Nifty200 Momentum 30 Index Fund Direct Growth Index Funds Very High Risk | ₹8,449 Cr | 0.39% | 20.3% |

Kotak Nifty Next 50 Index Fund Direct Growth Index Funds Very High Risk | ₹359 Cr | 0.11% | 19.4% |

DSP Nifty Next 50 Index Fund Direct Growth Index Funds Very High Risk | ₹844 Cr | 0.28% | 19.3% |

Motilal Oswal Nifty Next 50 Index Fund Direct Growth Index Funds Very High Risk | ₹309 Cr | 0.35% | 19.2% |

SBI Nifty Next 50 Index Fund Direct Growth Index Funds Very High Risk | ₹1,415 Cr | 0.32% | 19.2% |

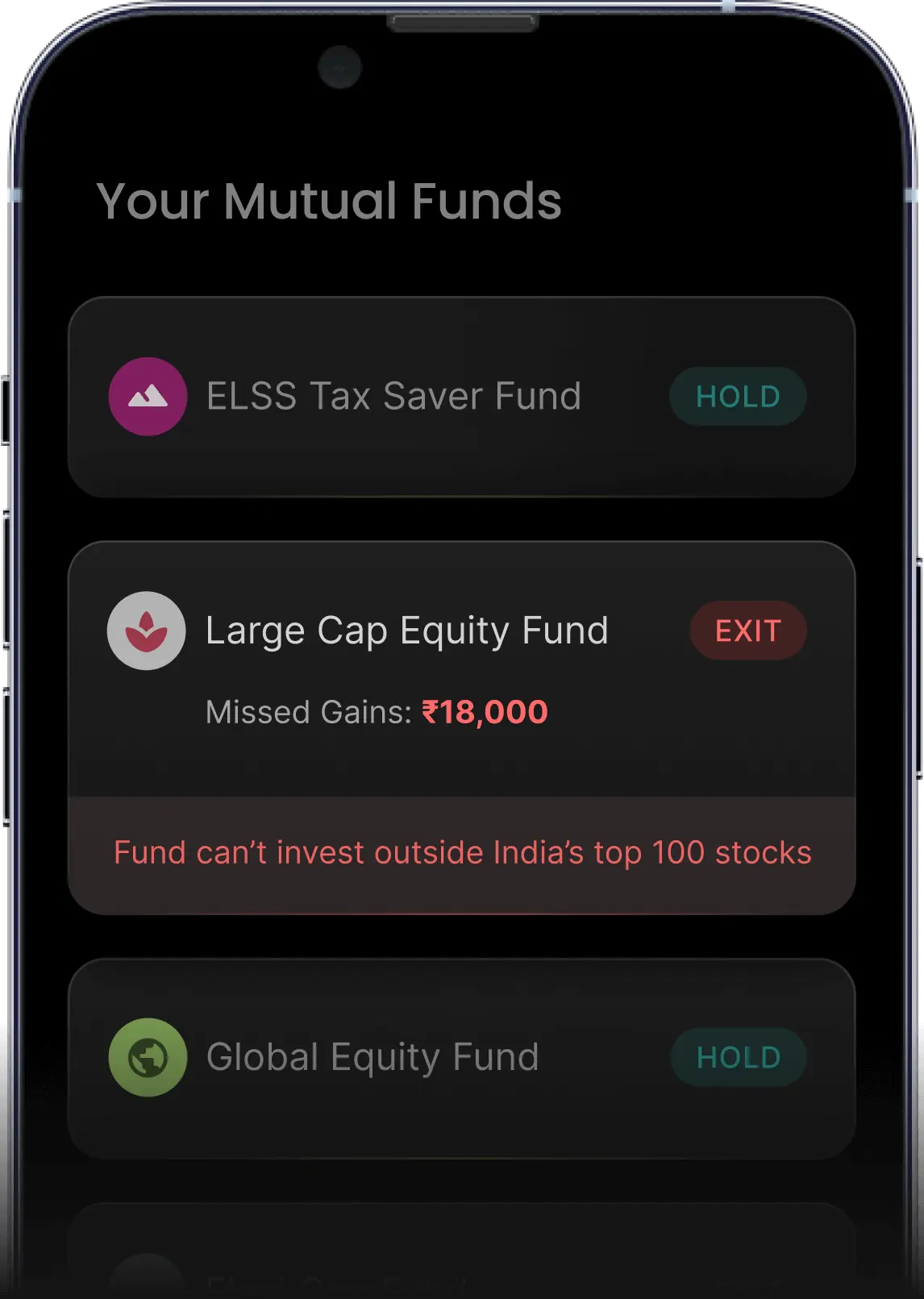

Identify red flags in your mutual funds and how to fix them

Equity index funds are mutual funds that adopt a passive investment strategy, allocating at least 95% of their assets to the securities of a specific index. Unlike actively managed funds where a fund manager tries to beat the market by picking individual stocks or bonds, index funds simply aim to mirror the performance of a specific market index.

Funds that invest in stocks according to an index's composition and weightage are called equity index funds. In contrast, a debt index fund tracks an index comprised of corporate debt, government securities, treasury bills, and state development loans.

A market index is like a benchmark that measures the performance of a particular slice of the stock market, and it's composed of a carefully selected group of stocks representing a specific market segment, e.g. Nifty 50, Nifty Bank, etc.

| Scheme Name | AUM (Cr.) |

| UTI Nifty 50 Equity index Fund | 16,712.48 |

| HDFC Equity index Fund Nifty 50 Plan | 13,808.17 |

| ICICI Prudential Nifty 50 Equity index Fund | 8,781.76 |

Source: AMFI website as of April 2024

While you should identify your risk profile and plan your financial goals before investing in index funds, here are some situations where they may fit in

Equity index funds are an excellent option for investors who are new to investing and may not have the expertise or time for in-depth market analysis. They provide a straightforward way to participate in the market's overall growth.

Equity index funds shine with a buy-and-hold strategy. They benefit from markets' long-term growth trajectory, allowing long-term compounding returns.

Equity index funds typically have lower expense ratios than actively managed funds because they require less active management. Investors looking to minimise costs and fees may find index funds attractive.

Equity index funds may be appreciated by those who prefer a hands-off, passive investment approach. These funds don't require constant monitoring or frequent buying and selling, making them a convenient choice for investors seeking simplicity.

| Short Term Capital Gains (STCG) Tax | Long Term Capital Gains (LTCG) Tax |

|---|---|

| Gains from an index fund held for up to 12 months are taxed at 20%. | Gains from an index fund held for more than 12 months are taxed at 12.5% with an exemption of up to Rs 1.25 lakh in a year. |

Equity index funds pay out dividends when you invest in their IDCW (Income Distribution Cum Withdrawal) option. Dividends are taxed at your marginal income tax rate, and TDS (Tax Deducted at Source) at 10% applies to dividends received more than Rs 5,000 per AMC per financial year.

For a detailed explanation click here to read our comprehensive guide on the taxation of index funds.

In an actively managed fund, the fund manager and the research team are responsible for selecting stocks for the fund’s portfolio, which can lead to bias when determining the constituents. This is not the case with equity index funds, as the stock selection is limited to companies featured on the chosen index.

Since index funds don't require active stock picking or extensive research, they have significantly lower management fees and operating expenses than actively managed funds. Minimal buying and selling within the fund reduces transaction costs which compound over time, potentially leading to significantly better net returns for investors. For example, UTI Nifty 50 Equity index Fund has an expense ratio of 0.35%. (as of April 2024).

Equity index funds provide built-in diversification as they track a basket of stocks or bonds. You can choose index funds that track specific sectors (like IT and banking), broader markets, or even specialised themes to diversify your portfolio strategically.

Equity index funds aim to replicate the performance of a market index, providing investors with returns that closely mirror the overall market. While they may not outperform the market, they also avoid significant underperformance, making them a reliable option for consistent returns.

The composition of the index that an equity index fund tracks is typically well-defined and publicly available. Investors can easily access information about the holdings and weightings of the fund, providing transparency and clarity about their investment.

Equity index funds are designed to match the market, not beat it, and if the index delivers average returns, so will your investment. They won't capture the outsized gains that can sometimes be achieved by actively managed funds that pick winning stocks.

Equity index funds still carry market risk, and if the overall market declines, the value of your equity index fund will also fall. Equity index funds don't have mechanisms to mitigate losses during market downturns.

You can't choose which individual stocks are included in your equity index fund, and your returns are tied to the index's performance. Since equity index funds generally follow a buy-and-hold strategy, they may not be as responsive to sudden market shifts as actively managed funds.

While equity index funds strive to replicate their benchmark index, there might be a minor difference in performance due to factors like expenses and the timing of trades. This difference is called "tracking error."

Equity index funds focused on a specific sector or theme carry higher risks associated with that segment. A downturn in that sector could disproportionately impact your investment.

Equity index funds offer Indian investors a straightforward, low-cost, and diversified way to participate in the growth of various market segments. They are particularly well-suited for beginner investors, those who prefer a passive approach, or anyone seeking cost-effective, long-term investment options. While they don't offer the potential for explosive gains like some actively managed funds, they provide reliable returns that tend to mirror the overall market performance. Before investing, consider your risk tolerance and be mindful of the potential for market fluctuations and sector-specific risks.

By Market Cap

By Diversification

By Sectors & Themes

By Solutions

Hybrid funds are a combination of equity and debt investments. The blend of these asset classes varies based on the fund's investment goals.

Debt Mutual Funds invest in fixed-income securities such as government bonds, corporate bonds, treasury bills, and other money market instruments.