Dezerv: Your Family’s Wealth Partner

Helps in achieving your financial goals

End-to-End Wealth Management

Personalised Investment Strategies

See how it works

Returns on ₹1Cr investment in Dezerv PMS (ERS strategy)

ERS Factsheet

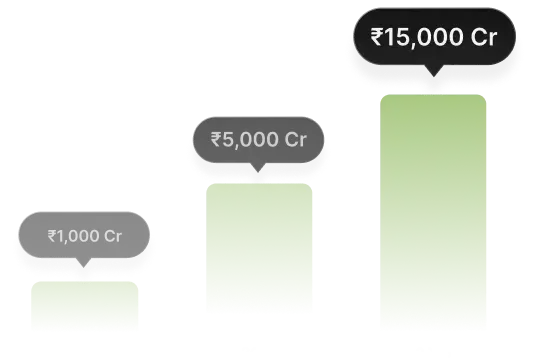

₹15k Cr+

Client assets in 4 years

₹15,000 cr+

Client assets in 4 years

5,000+

Clients trust Dezerv

20+ Years

Of experience

Dezerv is one of the top PMS in India

| S.No | Name | AUM |

|---|---|---|

| 1 | 360 One Portfolio Managers Limited | ₹35,643.75 Cr |

| 13 | Dezerv Investments Private Limited | ₹9,901.47 Cr |

| 15 | Julius Baer Wealth Advisors (India) Private Limited | ₹7,410.27 Cr |

Source APMI : As of 15th October 2025

Also, Motilal Oswal ranked Dezerv among the Top 10 PMS providers in India by Total AUM, after excluding EPFO and corporate AUM and clients (as of August 31, 2025).

Schedule a call to align your investments with financial goals

What you get on call

Talk to an expert about your goals

Free in depth analysis of the portfolio

Get a tailored portfolio for your goals

50% of high-net worth portfolios fail to beat the benchmark

Based on Dezerv’s App Analysis of ~54,000 portfolios with value of over INR 40 lakh each*

*As of 28th April, 2025

01

CREATE

We offer bouquet of investment approaches to suit your financial goals

02

TRACK

We track the market’s impact on your portfolio daily

03

EVALUATE

We evaluate and take action if your portfolio needs a change

04

UPDATE

Receive updates from your dedicated relationship manager

Our flagship PMS strategy delivered higher returns than market

“With Dezerv, I found the right partner for the next 25 years.”

Sanjay Arora

Founder, Suburban Diagnostics

“Investment experts at Dezerv have a solid investment thesis”

Aadil Bandukwala

Marketing Director, HackerRank

“Dezerv brought simplicity and clarity to my investments.”

Pooja Jauhari

Founder & CEO, EMoMee

“I am sure Dezerv will invest my money better than I could”

Brijesh Bharadwaj

Co-Founder, Segwise.ai

Only Pay for the

Profits You Make

Dezerv charges upto 10% of profits as fees for ERS strategy.

We charge fees on same profit only once.

Fixed Fee Plan

Pay a standard fixed fee of 1% of your portfolio

i.e., 0.25% of AUM is charged at the end of every quarter.

See how it works

Come visit us at any of our offices

Still got questions?

We're here to help.

What is Portfolio Management Service (PMS)?

What is the current state of the PMS industry in India?

What are the benefits of PMS?

Personalised Investing:

- Achieve Financial Goals & Create Long-term Wealth: Tailored strategies to meet individual financial objectives.

- Full Visibility of Transactions: Complete transparency regarding all portfolio transactions.

- Customised Asset Allocation: Personalised asset allocation plans based on risk tolerance and financial goals.

- Diversification to Reduce Risks: Minimise investment risks through diversification across various asset classes.

Expert Management:

- Professional Optimisation: Regular portfolio optimisation by experienced professionals.

- Dedicated Relationship Manager: Support and guidance from a dedicated relationship manager.

How are PMS different from mutual funds?

Portfolio Management Services (PMS) differ from mutual funds in three key ways:

- Ownership: In PMS, the stocks are held directly under your name, whereas in mutual funds, you own units of a fund that holds the stocks.

- Personalisation: PMS services are tailored to your individual investment needs and preferences, offering a personalised investment approach, while mutual funds follow a one-size-fits-all strategy based on specific objectives.

- Comprehensive Service: PMS provides a 360-degree investment service, including detailed portfolio management, while mutual funds are focused on helping you invest in pre-defined funds with specific goals.

Who Should Invest in PMS (Portfolio Management Services)?

The SEBI mandates a minimum investment of ₹50 lakh for Portfolio Management Services, up from ₹25 lakh before 2019.

Ideal Investors for PMS:

- High Net Worth Individuals (HNIs) and Ultra HNIs: Those with substantial assets.

- Busy Salaried Professionals: Individuals who lack time for active management.

- High-Income Business Owners: Entrepreneurs with significant disposable income.

- Inheritors of Family Wealth: Beneficiaries looking to preserve and grow their inheritance.

- ESOP Liquidation Beneficiaries: Individuals who have gained significant wealth through ESOPs.

How is Dezerv PMS different from other PMS providers?

- Zero Management Fees: More cost-effective, no management fees.

- Performance-Based Fees: Fees only when portfolio profits exceed a hurdle rate.

- Strong Track Record: Consistently outperforms the BSE 500 TRI index.

- Transparent and Accessible: User-friendly platform with clear reporting.

- Focus on Long-Term Wealth Creation: Emphasises sustainable portfolios over short-term gains.

- Technology-Driven Approach: Enhances investment processes and client communication through technology.

What are the types of Portfolio Management Services

Based on investment control

PMS services can have three types of controls based on who approves and executes portfolio manager-recommended transactions, and one service can have all three.

- Discretionary PMS

- Non-Discretionary PMS

- Advisory PMS

Based on the market cap focus

Market Capitalisation evaluates the value of the company based on its stocks.

- Large Cap

- Multi Cap

- Mid Cap

- Small Cap

A few PMS Services have strategies that focus on ‘Large & Mid Cap’ and ‘Mid & Small Cap’.

Additionally, a few strategies involve investing only in debt/bonds or ETFs to achieve investment objectives. However, many PMS service providers may not offer these strategies.