Fund Overview

Fund Size

₹7,392 Cr

Expense Ratio

1.83%

ISIN

INF109K01BI0

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

18 Oct 2007

About this fund

As of 17-Apr-25, it has a Net Asset Value (NAV) of ₹78.73, Assets Under Management (AUM) of 7392.39 Crores, and an expense ratio of 1.83%.

- ICICI Prudential Smallcap Fund Regular Growth has given a CAGR return of 12.52% since inception.

- The fund's asset allocation comprises around 86.70% in equities, 0.00% in debts, and 13.30% in cash & cash equivalents.

- You can start investing in ICICI Prudential Smallcap Fund Regular Growth with a SIP of ₹1000 or a Lumpsum investment of ₹5000.

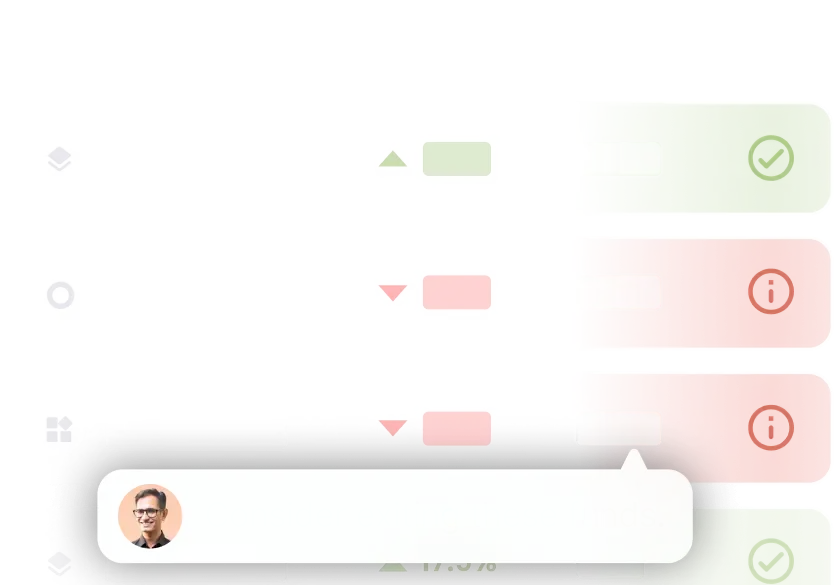

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+2.14%

+5.80% (Cat Avg.)

3 Years

+15.14%

+17.11% (Cat Avg.)

5 Years

+32.52%

+33.84% (Cat Avg.)

10 Years

+13.88%

+16.20% (Cat Avg.)

Since Inception

+12.52%

— (Cat Avg.)

Portfolio Summaryas of 31st March 2025

| Equity | ₹6,409.09 Cr | 86.70% |

| Others | ₹983.29 Cr | 13.30% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Treps | Cash - Repurchase Agreement | ₹949.47 Cr | 12.84% |

| UltraTech Cement Ltd | Equity | ₹339.23 Cr | 4.59% |

| Larsen & Toubro Ltd | Equity | ₹215.34 Cr | 2.91% |

| Gujarat Pipavav Port Ltd | Equity | ₹188.21 Cr | 2.55% |

| Atul Ltd | Equity | ₹183.01 Cr | 2.48% |

| Procter & Gamble Health Ltd | Equity | ₹178.93 Cr | 2.42% |

| Tata Chemicals Ltd | Equity | ₹168.32 Cr | 2.28% |

| Cummins India Ltd | Equity | ₹155.01 Cr | 2.10% |

| Gujarat State Petronet Ltd | Equity | ₹154.86 Cr | 2.09% |

| Gillette India Ltd | Equity | ₹148.15 Cr | 2.00% |

| TVS Holdings Ltd | Equity | ₹136.98 Cr | 1.85% |

| Hero MotoCorp Ltd | Equity | ₹134.06 Cr | 1.81% |

| Gujarat Narmada Valley Fertilizers & Chemicals Ltd | Equity | ₹121.77 Cr | 1.65% |

| Grindwell Norton Ltd | Equity | ₹109.84 Cr | 1.49% |

| EIH Ltd | Equity | ₹101.51 Cr | 1.37% |

| CESC Ltd | Equity | ₹98.16 Cr | 1.33% |

| Sanofi Consumer Healthcare India Ltd | Equity | ₹95.88 Cr | 1.30% |

| JK Lakshmi Cement Ltd | Equity | ₹94.92 Cr | 1.28% |

| Pfizer Ltd | Equity | ₹93.06 Cr | 1.26% |

| Gujarat Alkalies & Chemicals Ltd | Equity | ₹92.29 Cr | 1.25% |

| Jamna Auto Industries Ltd | Equity | ₹85.58 Cr | 1.16% |

| Gujarat State Fertilizers & Chemicals Ltd | Equity | ₹85.52 Cr | 1.16% |

| Dalmia Bharat Ltd | Equity | ₹82.42 Cr | 1.11% |

| Birla Corp Ltd | Equity | ₹81.75 Cr | 1.11% |

| Carborundum Universal Ltd | Equity | ₹80.42 Cr | 1.09% |

| SKF India Ltd | Equity | ₹80.36 Cr | 1.09% |

| Schaeffler India Ltd | Equity | ₹76.32 Cr | 1.03% |

| AstraZeneca Pharma India Ltd | Equity | ₹75.14 Cr | 1.02% |

| Multi Commodity Exchange of India Ltd | Equity | ₹75.07 Cr | 1.02% |

| Ingersoll-Rand (India) Ltd | Equity | ₹71.67 Cr | 0.97% |

| Gateway Distriparks Ltd | Equity | ₹68.67 Cr | 0.93% |

| Rolex Rings Ltd | Equity | ₹67.56 Cr | 0.91% |

| Galaxy Surfactants Ltd | Equity | ₹66.32 Cr | 0.90% |

| FDC Ltd | Equity | ₹65.46 Cr | 0.89% |

| Nuvoco Vista Corp Ltd | Equity | ₹62.73 Cr | 0.85% |

| Graphite India Ltd | Equity | ₹61.33 Cr | 0.83% |

| Cyient Ltd | Equity | ₹60.11 Cr | 0.81% |

| Repco Home Finance Ltd | Equity | ₹60 Cr | 0.81% |

| Supreme Petrochem Ltd | Equity | ₹59.84 Cr | 0.81% |

| JM Financial Ltd | Equity | ₹59.04 Cr | 0.80% |

| Andhra Paper Ltd | Equity | ₹58.98 Cr | 0.80% |

| Computer Age Management Services Ltd Ordinary Shares | Equity | ₹57.57 Cr | 0.78% |

| Indian Energy Exchange Ltd | Equity | ₹55.86 Cr | 0.76% |

| Kansai Nerolac Paints Ltd | Equity | ₹54.35 Cr | 0.74% |

| Camlin Fine Sciences Ltd | Equity | ₹53.8 Cr | 0.73% |

| GHCL Ltd | Equity | ₹53.46 Cr | 0.72% |

| ICRA Ltd | Equity | ₹51.37 Cr | 0.69% |

| PNC Infratech Ltd | Equity | ₹50.92 Cr | 0.69% |

| United Breweries Ltd | Equity | ₹49.25 Cr | 0.67% |

| CIE Automotive India Ltd | Equity | ₹47.68 Cr | 0.64% |

| Mold-tek Packaging Ltd | Equity | ₹47.45 Cr | 0.64% |

| Orient Electric Ltd Ordinary Shares | Equity | ₹47.09 Cr | 0.64% |

| HeidelbergCement India Ltd | Equity | ₹45.48 Cr | 0.62% |

| IndiaMART InterMESH Ltd | Equity | ₹44.44 Cr | 0.60% |

| Sagar Cements Ltd | Equity | ₹43.85 Cr | 0.59% |

| Brigade Enterprises Ltd | Equity | ₹42.61 Cr | 0.58% |

| KSB Ltd | Equity | ₹42.11 Cr | 0.57% |

| Windlas Biotech Ltd | Equity | ₹40.95 Cr | 0.55% |

| G R Infraprojects Ltd | Equity | ₹40.14 Cr | 0.54% |

| Ramco Cements Ltd | Equity | ₹40.14 Cr | 0.54% |

| Shree Cement Ltd | Equity | ₹40.05 Cr | 0.54% |

| LIC Housing Finance Ltd | Equity | ₹39.63 Cr | 0.54% |

| Nirlon Ltd | Equity | ₹39.17 Cr | 0.53% |

| Chennai Petroleum Corp Ltd | Equity | ₹38.25 Cr | 0.52% |

| Maruti Suzuki India Ltd | Equity | ₹36.9 Cr | 0.50% |

| Tamil Nadu Newsprint & Papers Ltd | Equity | ₹36.27 Cr | 0.49% |

| Aarti Industries Ltd | Equity | ₹35.99 Cr | 0.49% |

| Alembic Pharmaceuticals Ltd | Equity | ₹35.94 Cr | 0.49% |

| RHI Magnesita India Ltd | Equity | ₹35.71 Cr | 0.48% |

| Affle India Ltd | Equity | ₹35.46 Cr | 0.48% |

| NCC Ltd | Equity | ₹34.23 Cr | 0.46% |

| Rain Industries Ltd | Equity | ₹34.21 Cr | 0.46% |

| DCM Shriram Ltd | Equity | ₹34.14 Cr | 0.46% |

| Mangalore Refinery and Petrochemicals Ltd | Equity | ₹34.1 Cr | 0.46% |

| Sundaram Fasteners Ltd | Equity | ₹33.17 Cr | 0.45% |

| Max Financial Services Ltd | Equity | ₹33.14 Cr | 0.45% |

| CMS Info Systems Ltd | Equity | ₹32.29 Cr | 0.44% |

| Timken India Ltd | Equity | ₹31.84 Cr | 0.43% |

| 3M India Ltd | Equity | ₹30.35 Cr | 0.41% |

| Divgi TorqTransfer Systems Ltd | Equity | ₹27.63 Cr | 0.37% |

| Birlasoft Ltd | Equity | ₹27.29 Cr | 0.37% |

| Matrimony.com Ltd | Equity | ₹26.76 Cr | 0.36% |

| UTI Asset Management Co Ltd | Equity | ₹26.66 Cr | 0.36% |

| Kewal Kiran Clothing Ltd | Equity | ₹26.36 Cr | 0.36% |

| 91 DTB 10042025 | Bond - Gov't/Treasury | ₹24.96 Cr | 0.34% |

| TeamLease Services Ltd | Equity | ₹24.18 Cr | 0.33% |

| Motherson Sumi Wiring India Ltd | Equity | ₹23.06 Cr | 0.31% |

| Kirloskar Ferrous Industries Ltd | Equity | ₹22.99 Cr | 0.31% |

| Navin Fluorine International Ltd | Equity | ₹21.22 Cr | 0.29% |

| Universal Cables Ltd | Equity | ₹20.95 Cr | 0.28% |

| Vardhman Special Steels Ltd | Equity | ₹20 Cr | 0.27% |

| Jyothy Labs Ltd | Equity | ₹19.99 Cr | 0.27% |

| India Cements Ltd | Equity | ₹19.06 Cr | 0.26% |

| Automotive Axles Ltd | Equity | ₹18.38 Cr | 0.25% |

| Page Industries Ltd | Equity | ₹18.38 Cr | 0.25% |

| VST Tillers Tractors Ltd | Equity | ₹18.33 Cr | 0.25% |

| Bayer CropScience Ltd | Equity | ₹18.26 Cr | 0.25% |

| Coal India Ltd | Equity | ₹17.73 Cr | 0.24% |

| Chemplast Sanmar Ltd | Equity | ₹17.5 Cr | 0.24% |

| Tatva Chintan Pharma Chem Ltd | Equity | ₹17.02 Cr | 0.23% |

| Nesco Ltd | Equity | ₹15.98 Cr | 0.22% |

| Rategain Travel Technologies Ltd | Equity | ₹15.87 Cr | 0.21% |

| Gufic Biosciences Ltd | Equity | ₹15.31 Cr | 0.21% |

| JTEKT India Ltd | Equity | ₹14.51 Cr | 0.20% |

| Kalpataru Projects International Ltd | Equity | ₹13.06 Cr | 0.18% |

| Ashok Leyland Ltd | Equity | ₹12.33 Cr | 0.17% |

| Kalyani Steels Ltd | Equity | ₹6.48 Cr | 0.09% |

| Route Mobile Ltd Ordinary Shares | Equity | ₹5.76 Cr | 0.08% |

| 91 Days Tbill | Bond - Gov't/Treasury | ₹4.97 Cr | 0.07% |

| Kesoram Industries Ltd | Equity | ₹3.16 Cr | 0.04% |

| Cash Margin - Derivatives | Cash - Collateral | ₹2.7 Cr | 0.04% |

| 91 Days Tbill Red 24-04-2025 | Bond - Gov't/Treasury | ₹1.99 Cr | 0.03% |

| Net Current Assets | Cash | ₹-1.8 Cr | 0.02% |

| Advanced Enzyme Technologies Ltd | Equity | ₹1.67 Cr | 0.02% |

| India (Republic of) | Bond - Short-term Government Bills | ₹1 Cr | 0.01% |

Allocation By Market Cap (Equity)

Large Cap Stocks

12.15%

Mid Cap Stocks

5.17%

Small Cap Stocks

69.38%

Allocation By Credit Quality (Debt)

AAA

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Basic Materials | ₹2,059.09 Cr | 27.85% |

| Industrials | ₹1,618.08 Cr | 21.89% |

| Consumer Cyclical | ₹875.07 Cr | 11.84% |

| Healthcare | ₹600.68 Cr | 8.13% |

| Financial Services | ₹400.77 Cr | 5.42% |

| Utilities | ₹253.02 Cr | 3.42% |

| Consumer Defensive | ₹217.39 Cr | 2.94% |

| Communication Services | ₹112.4 Cr | 1.52% |

| Technology | ₹100.73 Cr | 1.36% |

| Energy | ₹90.08 Cr | 1.22% |

| Real Estate | ₹81.78 Cr | 1.11% |

Risk & Performance Ratios

Standard Deviation

This fund

15.15%

Cat. avg.

17.43%

Lower the better

Sharpe Ratio

This fund

0.57

Cat. avg.

0.64

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.01

Higher the better

Fund Managers

Additional Scheme Detailsas of 31st March 2025

ISIN INF109K01BI0 | Expense Ratio 1.83% | Exit Load 1.00% | Fund Size ₹7,392 Cr | Age 17 years 6 months | Lumpsum Minimum ₹5,000 | Fund Status Open Ended Investment Company | Benchmark Nifty Smallcap 250 TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Small-Cap Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Mirae Asset Small Cap Fund Regular Growth Very High Risk | 2.1% | 1.0% | ₹1263.28 Cr | - |

| Mirae Asset Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1263.28 Cr | - |

| TrustMF Small Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹817.25 Cr | - |

| TrustMF Small Cap Fund Regular Growth Very High Risk | 2.2% | 1.0% | ₹817.25 Cr | - |

| JM Small Cap Fund Regular Growth Very High Risk | 2.3% | 1.0% | ₹594.06 Cr | - |

| JM Small Cap Fund Direct Growth Very High Risk | 0.7% | 1.0% | ₹594.06 Cr | - |

| Motilal Oswal Nifty Smallcap 250 ETF Very High Risk | 0.3% | - | ₹84.94 Cr | 1.6% |

| Motilal Oswal Small Cap Fund Regular Growth Very High Risk | 1.8% | 1.0% | ₹4166.58 Cr | 17.4% |

| Motilal Oswal Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹4166.58 Cr | 19.1% |

| Quantum Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹108.01 Cr | 6.8% |

About the AMC

ICICI Prudential Mutual Fund

Total AUM

₹8,67,406 Cr

Address

3rd Floor, Hallmark Business Plaza, Mumbai, 400 051

Other Funds by ICICI Prudential Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of ICICI Prudential Smallcap Fund Regular Growth?

What are the returns of ICICI Prudential Smallcap Fund Regular Growth?

What is the portfolio composition of ICICI Prudential Smallcap Fund Regular Growth?

Who manages the ICICI Prudential Smallcap Fund Regular Growth?

- Anish Tawakley

- Sri Sharma

- Sharmila D’mello

NAV (17-Apr-25)

Returns (Since Inception)

Fund Overview

Fund Size

₹7,392 Cr

Expense Ratio

1.83%

ISIN

INF109K01BI0

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

18 Oct 2007

Risk Level

Your principal amount will be at Very High Risk

About this fund

As of 17-Apr-25, it has a Net Asset Value (NAV) of ₹78.73, Assets Under Management (AUM) of 7392.39 Crores, and an expense ratio of 1.83%.

- ICICI Prudential Smallcap Fund Regular Growth has given a CAGR return of 12.52% since inception.

- The fund's asset allocation comprises around 86.70% in equities, 0.00% in debts, and 13.30% in cash & cash equivalents.

- You can start investing in ICICI Prudential Smallcap Fund Regular Growth with a SIP of ₹1000 or a Lumpsum investment of ₹5000.

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+2.14%

+5.80% (Cat Avg.)

3 Years

+15.14%

+17.11% (Cat Avg.)

5 Years

+32.52%

+33.84% (Cat Avg.)

10 Years

+13.88%

+16.20% (Cat Avg.)

Since Inception

+12.52%

— (Cat Avg.)

Portfolio Summaryas of 31st March 2025

| Equity | ₹6,409.09 Cr | 86.70% |

| Others | ₹983.29 Cr | 13.30% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Treps | Cash - Repurchase Agreement | ₹949.47 Cr | 12.84% |

| UltraTech Cement Ltd | Equity | ₹339.23 Cr | 4.59% |

| Larsen & Toubro Ltd | Equity | ₹215.34 Cr | 2.91% |

| Gujarat Pipavav Port Ltd | Equity | ₹188.21 Cr | 2.55% |

| Atul Ltd | Equity | ₹183.01 Cr | 2.48% |

| Procter & Gamble Health Ltd | Equity | ₹178.93 Cr | 2.42% |

| Tata Chemicals Ltd | Equity | ₹168.32 Cr | 2.28% |

| Cummins India Ltd | Equity | ₹155.01 Cr | 2.10% |

| Gujarat State Petronet Ltd | Equity | ₹154.86 Cr | 2.09% |

| Gillette India Ltd | Equity | ₹148.15 Cr | 2.00% |

| TVS Holdings Ltd | Equity | ₹136.98 Cr | 1.85% |

| Hero MotoCorp Ltd | Equity | ₹134.06 Cr | 1.81% |

| Gujarat Narmada Valley Fertilizers & Chemicals Ltd | Equity | ₹121.77 Cr | 1.65% |

| Grindwell Norton Ltd | Equity | ₹109.84 Cr | 1.49% |

| EIH Ltd | Equity | ₹101.51 Cr | 1.37% |

| CESC Ltd | Equity | ₹98.16 Cr | 1.33% |

| Sanofi Consumer Healthcare India Ltd | Equity | ₹95.88 Cr | 1.30% |

| JK Lakshmi Cement Ltd | Equity | ₹94.92 Cr | 1.28% |

| Pfizer Ltd | Equity | ₹93.06 Cr | 1.26% |

| Gujarat Alkalies & Chemicals Ltd | Equity | ₹92.29 Cr | 1.25% |

| Jamna Auto Industries Ltd | Equity | ₹85.58 Cr | 1.16% |

| Gujarat State Fertilizers & Chemicals Ltd | Equity | ₹85.52 Cr | 1.16% |

| Dalmia Bharat Ltd | Equity | ₹82.42 Cr | 1.11% |

| Birla Corp Ltd | Equity | ₹81.75 Cr | 1.11% |

| Carborundum Universal Ltd | Equity | ₹80.42 Cr | 1.09% |

| SKF India Ltd | Equity | ₹80.36 Cr | 1.09% |

| Schaeffler India Ltd | Equity | ₹76.32 Cr | 1.03% |

| AstraZeneca Pharma India Ltd | Equity | ₹75.14 Cr | 1.02% |

| Multi Commodity Exchange of India Ltd | Equity | ₹75.07 Cr | 1.02% |

| Ingersoll-Rand (India) Ltd | Equity | ₹71.67 Cr | 0.97% |

| Gateway Distriparks Ltd | Equity | ₹68.67 Cr | 0.93% |

| Rolex Rings Ltd | Equity | ₹67.56 Cr | 0.91% |

| Galaxy Surfactants Ltd | Equity | ₹66.32 Cr | 0.90% |

| FDC Ltd | Equity | ₹65.46 Cr | 0.89% |

| Nuvoco Vista Corp Ltd | Equity | ₹62.73 Cr | 0.85% |

| Graphite India Ltd | Equity | ₹61.33 Cr | 0.83% |

| Cyient Ltd | Equity | ₹60.11 Cr | 0.81% |

| Repco Home Finance Ltd | Equity | ₹60 Cr | 0.81% |

| Supreme Petrochem Ltd | Equity | ₹59.84 Cr | 0.81% |

| JM Financial Ltd | Equity | ₹59.04 Cr | 0.80% |

| Andhra Paper Ltd | Equity | ₹58.98 Cr | 0.80% |

| Computer Age Management Services Ltd Ordinary Shares | Equity | ₹57.57 Cr | 0.78% |

| Indian Energy Exchange Ltd | Equity | ₹55.86 Cr | 0.76% |

| Kansai Nerolac Paints Ltd | Equity | ₹54.35 Cr | 0.74% |

| Camlin Fine Sciences Ltd | Equity | ₹53.8 Cr | 0.73% |

| GHCL Ltd | Equity | ₹53.46 Cr | 0.72% |

| ICRA Ltd | Equity | ₹51.37 Cr | 0.69% |

| PNC Infratech Ltd | Equity | ₹50.92 Cr | 0.69% |

| United Breweries Ltd | Equity | ₹49.25 Cr | 0.67% |

| CIE Automotive India Ltd | Equity | ₹47.68 Cr | 0.64% |

| Mold-tek Packaging Ltd | Equity | ₹47.45 Cr | 0.64% |

| Orient Electric Ltd Ordinary Shares | Equity | ₹47.09 Cr | 0.64% |

| HeidelbergCement India Ltd | Equity | ₹45.48 Cr | 0.62% |

| IndiaMART InterMESH Ltd | Equity | ₹44.44 Cr | 0.60% |

| Sagar Cements Ltd | Equity | ₹43.85 Cr | 0.59% |

| Brigade Enterprises Ltd | Equity | ₹42.61 Cr | 0.58% |

| KSB Ltd | Equity | ₹42.11 Cr | 0.57% |

| Windlas Biotech Ltd | Equity | ₹40.95 Cr | 0.55% |

| G R Infraprojects Ltd | Equity | ₹40.14 Cr | 0.54% |

| Ramco Cements Ltd | Equity | ₹40.14 Cr | 0.54% |

| Shree Cement Ltd | Equity | ₹40.05 Cr | 0.54% |

| LIC Housing Finance Ltd | Equity | ₹39.63 Cr | 0.54% |

| Nirlon Ltd | Equity | ₹39.17 Cr | 0.53% |

| Chennai Petroleum Corp Ltd | Equity | ₹38.25 Cr | 0.52% |

| Maruti Suzuki India Ltd | Equity | ₹36.9 Cr | 0.50% |

| Tamil Nadu Newsprint & Papers Ltd | Equity | ₹36.27 Cr | 0.49% |

| Aarti Industries Ltd | Equity | ₹35.99 Cr | 0.49% |

| Alembic Pharmaceuticals Ltd | Equity | ₹35.94 Cr | 0.49% |

| RHI Magnesita India Ltd | Equity | ₹35.71 Cr | 0.48% |

| Affle India Ltd | Equity | ₹35.46 Cr | 0.48% |

| NCC Ltd | Equity | ₹34.23 Cr | 0.46% |

| Rain Industries Ltd | Equity | ₹34.21 Cr | 0.46% |

| DCM Shriram Ltd | Equity | ₹34.14 Cr | 0.46% |

| Mangalore Refinery and Petrochemicals Ltd | Equity | ₹34.1 Cr | 0.46% |

| Sundaram Fasteners Ltd | Equity | ₹33.17 Cr | 0.45% |

| Max Financial Services Ltd | Equity | ₹33.14 Cr | 0.45% |

| CMS Info Systems Ltd | Equity | ₹32.29 Cr | 0.44% |

| Timken India Ltd | Equity | ₹31.84 Cr | 0.43% |

| 3M India Ltd | Equity | ₹30.35 Cr | 0.41% |

| Divgi TorqTransfer Systems Ltd | Equity | ₹27.63 Cr | 0.37% |

| Birlasoft Ltd | Equity | ₹27.29 Cr | 0.37% |

| Matrimony.com Ltd | Equity | ₹26.76 Cr | 0.36% |

| UTI Asset Management Co Ltd | Equity | ₹26.66 Cr | 0.36% |

| Kewal Kiran Clothing Ltd | Equity | ₹26.36 Cr | 0.36% |

| 91 DTB 10042025 | Bond - Gov't/Treasury | ₹24.96 Cr | 0.34% |

| TeamLease Services Ltd | Equity | ₹24.18 Cr | 0.33% |

| Motherson Sumi Wiring India Ltd | Equity | ₹23.06 Cr | 0.31% |

| Kirloskar Ferrous Industries Ltd | Equity | ₹22.99 Cr | 0.31% |

| Navin Fluorine International Ltd | Equity | ₹21.22 Cr | 0.29% |

| Universal Cables Ltd | Equity | ₹20.95 Cr | 0.28% |

| Vardhman Special Steels Ltd | Equity | ₹20 Cr | 0.27% |

| Jyothy Labs Ltd | Equity | ₹19.99 Cr | 0.27% |

| India Cements Ltd | Equity | ₹19.06 Cr | 0.26% |

| Automotive Axles Ltd | Equity | ₹18.38 Cr | 0.25% |

| Page Industries Ltd | Equity | ₹18.38 Cr | 0.25% |

| VST Tillers Tractors Ltd | Equity | ₹18.33 Cr | 0.25% |

| Bayer CropScience Ltd | Equity | ₹18.26 Cr | 0.25% |

| Coal India Ltd | Equity | ₹17.73 Cr | 0.24% |

| Chemplast Sanmar Ltd | Equity | ₹17.5 Cr | 0.24% |

| Tatva Chintan Pharma Chem Ltd | Equity | ₹17.02 Cr | 0.23% |

| Nesco Ltd | Equity | ₹15.98 Cr | 0.22% |

| Rategain Travel Technologies Ltd | Equity | ₹15.87 Cr | 0.21% |

| Gufic Biosciences Ltd | Equity | ₹15.31 Cr | 0.21% |

| JTEKT India Ltd | Equity | ₹14.51 Cr | 0.20% |

| Kalpataru Projects International Ltd | Equity | ₹13.06 Cr | 0.18% |

| Ashok Leyland Ltd | Equity | ₹12.33 Cr | 0.17% |

| Kalyani Steels Ltd | Equity | ₹6.48 Cr | 0.09% |

| Route Mobile Ltd Ordinary Shares | Equity | ₹5.76 Cr | 0.08% |

| 91 Days Tbill | Bond - Gov't/Treasury | ₹4.97 Cr | 0.07% |

| Kesoram Industries Ltd | Equity | ₹3.16 Cr | 0.04% |

| Cash Margin - Derivatives | Cash - Collateral | ₹2.7 Cr | 0.04% |

| 91 Days Tbill Red 24-04-2025 | Bond - Gov't/Treasury | ₹1.99 Cr | 0.03% |

| Net Current Assets | Cash | ₹-1.8 Cr | 0.02% |

| Advanced Enzyme Technologies Ltd | Equity | ₹1.67 Cr | 0.02% |

| India (Republic of) | Bond - Short-term Government Bills | ₹1 Cr | 0.01% |

Allocation By Market Cap (Equity)

Large Cap Stocks

12.15%

Mid Cap Stocks

5.17%

Small Cap Stocks

69.38%

Allocation By Credit Quality (Debt)

AAA

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Basic Materials | ₹2,059.09 Cr | 27.85% |

| Industrials | ₹1,618.08 Cr | 21.89% |

| Consumer Cyclical | ₹875.07 Cr | 11.84% |

| Healthcare | ₹600.68 Cr | 8.13% |

| Financial Services | ₹400.77 Cr | 5.42% |

| Utilities | ₹253.02 Cr | 3.42% |

| Consumer Defensive | ₹217.39 Cr | 2.94% |

| Communication Services | ₹112.4 Cr | 1.52% |

| Technology | ₹100.73 Cr | 1.36% |

| Energy | ₹90.08 Cr | 1.22% |

| Real Estate | ₹81.78 Cr | 1.11% |

Risk & Performance Ratios

Standard Deviation

This fund

15.15%

Cat. avg.

17.43%

Lower the better

Sharpe Ratio

This fund

0.57

Cat. avg.

0.64

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.01

Higher the better

Fund Managers

Additional Scheme Detailsas of 31st March 2025

ISIN INF109K01BI0 | Expense Ratio 1.83% | Exit Load 1.00% | Fund Size ₹7,392 Cr | Age 17 years 6 months | Lumpsum Minimum ₹5,000 | Fund Status Open Ended Investment Company | Benchmark Nifty Smallcap 250 TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Small-Cap Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Mirae Asset Small Cap Fund Regular Growth Very High Risk | 2.1% | 1.0% | ₹1263.28 Cr | - |

| Mirae Asset Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1263.28 Cr | - |

| TrustMF Small Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹817.25 Cr | - |

| TrustMF Small Cap Fund Regular Growth Very High Risk | 2.2% | 1.0% | ₹817.25 Cr | - |

| JM Small Cap Fund Regular Growth Very High Risk | 2.3% | 1.0% | ₹594.06 Cr | - |

| JM Small Cap Fund Direct Growth Very High Risk | 0.7% | 1.0% | ₹594.06 Cr | - |

| Motilal Oswal Nifty Smallcap 250 ETF Very High Risk | 0.3% | - | ₹84.94 Cr | 1.6% |

| Motilal Oswal Small Cap Fund Regular Growth Very High Risk | 1.8% | 1.0% | ₹4166.58 Cr | 17.4% |

| Motilal Oswal Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹4166.58 Cr | 19.1% |

| Quantum Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹108.01 Cr | 6.8% |

About the AMC

ICICI Prudential Mutual Fund

Total AUM

₹8,67,406 Cr

Address

3rd Floor, Hallmark Business Plaza, Mumbai, 400 051

Other Funds by ICICI Prudential Mutual Fund

Still got questions?

We're here to help.

What is the current NAV of ICICI Prudential Smallcap Fund Regular Growth?

What are the returns of ICICI Prudential Smallcap Fund Regular Growth?

What is the portfolio composition of ICICI Prudential Smallcap Fund Regular Growth?

Who manages the ICICI Prudential Smallcap Fund Regular Growth?

- Anish Tawakley

- Sri Sharma

- Sharmila D’mello

Get your portfolio reviewed by experts