Fund Overview

Fund Size

₹9,516 Cr

Expense Ratio

0.50%

ISIN

INF194KB1AL4

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

26 Feb 2020

About this fund

As of 17-Apr-25, it has a Net Asset Value (NAV) of ₹45.59, Assets Under Management (AUM) of 9516.16 Crores, and an expense ratio of 0.5%.

- Bandhan Emerging Businesses Fund Direct Growth has given a CAGR return of 34.34% since inception.

- The fund's asset allocation comprises around 89.26% in equities, 0.00% in debts, and 10.74% in cash & cash equivalents.

- You can start investing in Bandhan Emerging Businesses Fund Direct Growth with a SIP of ₹1000 or a Lumpsum investment of ₹1000.

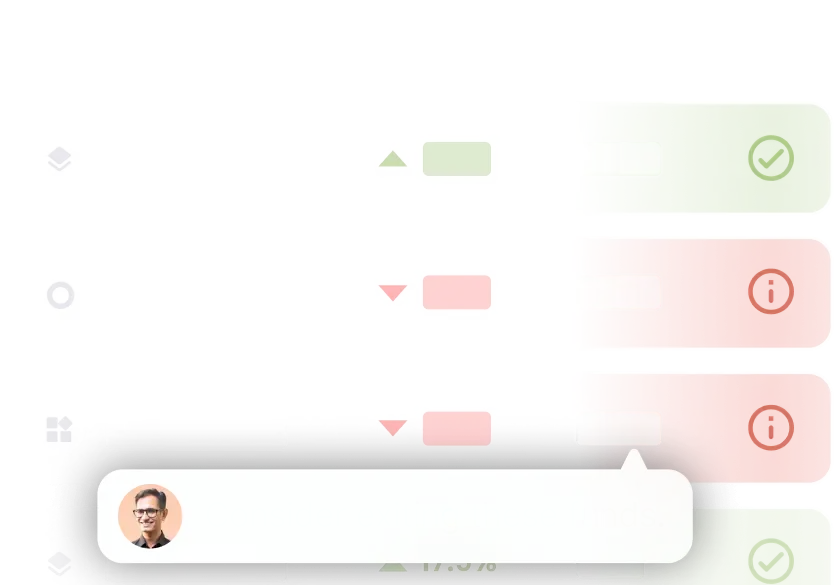

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+17.60%

+5.80% (Cat Avg.)

3 Years

+26.52%

+17.11% (Cat Avg.)

5 Years

+37.40%

+33.84% (Cat Avg.)

Since Inception

+34.34%

— (Cat Avg.)

Portfolio Summaryas of 31st March 2025

| Equity | ₹8,493.87 Cr | 89.26% |

| Others | ₹1,022.29 Cr | 10.74% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Triparty Repo Trp_020425 | Cash - Repurchase Agreement | ₹1,033.6 Cr | 10.86% |

| Sobha Ltd | Equity | ₹264.78 Cr | 2.78% |

| LT Foods Ltd | Equity | ₹251.4 Cr | 2.64% |

| PCBL Chemical Ltd | Equity | ₹220.02 Cr | 2.31% |

| The South Indian Bank Ltd | Equity | ₹210.5 Cr | 2.21% |

| Cholamandalam Financial Holdings Ltd | Equity | ₹206.4 Cr | 2.17% |

| Arvind Ltd | Equity | ₹156.88 Cr | 1.65% |

| Shaily Engineering Plastics Ltd | Equity | ₹151.07 Cr | 1.59% |

| Yatharth Hospital and Trauma Care Services Ltd | Equity | ₹138.04 Cr | 1.45% |

| Karnataka Bank Ltd | Equity | ₹120.25 Cr | 1.26% |

| Apar Industries Ltd | Equity | ₹116.76 Cr | 1.23% |

| REC Ltd | Equity | ₹114.55 Cr | 1.20% |

| Manappuram Finance Ltd | Equity | ₹111.24 Cr | 1.17% |

| Inox Wind Energy Ltd Ordinary Shares | Equity | ₹110.93 Cr | 1.17% |

| Glenmark Pharmaceuticals Ltd | Equity | ₹103.77 Cr | 1.09% |

| TVS Holdings Ltd | Equity | ₹103.73 Cr | 1.09% |

| Rashi Peripherals Ltd | Equity | ₹99.52 Cr | 1.05% |

| Nitin Spinners Ltd | Equity | ₹92.12 Cr | 0.97% |

| Power Finance Corp Ltd | Equity | ₹91.11 Cr | 0.96% |

| IndusInd Bank Ltd | Equity | ₹89.17 Cr | 0.94% |

| Kirloskar Oil Engines Ltd | Equity | ₹88.56 Cr | 0.93% |

| Prestige Estates Projects Ltd | Equity | ₹87.58 Cr | 0.92% |

| Motilal Oswal Financial Services Ltd | Equity | ₹83.72 Cr | 0.88% |

| Sanathan Textiles Ltd | Equity | ₹83.1 Cr | 0.87% |

| eClerx Services Ltd | Equity | ₹82.96 Cr | 0.87% |

| Cyient Ltd | Equity | ₹81.72 Cr | 0.86% |

| PNB Housing Finance Ltd | Equity | ₹80.43 Cr | 0.85% |

| Shilpa Medicare Ltd | Equity | ₹78.36 Cr | 0.82% |

| Jupiter Wagons Ltd | Equity | ₹77.82 Cr | 0.82% |

| Godawari Power & Ispat Ltd | Equity | ₹77.03 Cr | 0.81% |

| Kolte-Patil Developers Ltd | Equity | ₹76.29 Cr | 0.80% |

| Aurobindo Pharma Ltd | Equity | ₹75.48 Cr | 0.79% |

| Vedanta Ltd | Equity | ₹74.4 Cr | 0.78% |

| TARC Ltd Ordinary Shares | Equity | ₹74.06 Cr | 0.78% |

| Signatureglobal (India) Ltd | Equity | ₹73.76 Cr | 0.78% |

| Wockhardt Ltd | Equity | ₹71.85 Cr | 0.75% |

| Stove Kraft Ltd Ordinary Shares | Equity | ₹71.02 Cr | 0.75% |

| Angel One Ltd Ordinary Shares | Equity | ₹69.47 Cr | 0.73% |

| Amara Raja Energy & Mobility Ltd | Equity | ₹65.92 Cr | 0.69% |

| Aster DM Healthcare Ltd Ordinary Shares | Equity | ₹65.47 Cr | 0.69% |

| Eris Lifesciences Ltd Registered Shs | Equity | ₹65.08 Cr | 0.68% |

| Deepak Fertilisers & Petrochemicals Corp Ltd | Equity | ₹64.92 Cr | 0.68% |

| Inox Wind Ltd | Equity | ₹64.81 Cr | 0.68% |

| NCC Ltd | Equity | ₹64.41 Cr | 0.68% |

| Piramal Pharma Ltd | Equity | ₹63.36 Cr | 0.67% |

| Kirloskar Ferrous Industries Ltd | Equity | ₹62.78 Cr | 0.66% |

| Neuland Laboratories Limited | Equity | ₹61.76 Cr | 0.65% |

| Jubilant Pharmova Ltd | Equity | ₹61 Cr | 0.64% |

| Radico Khaitan Ltd | Equity | ₹59 Cr | 0.62% |

| Bank of Baroda | Equity | ₹58.95 Cr | 0.62% |

| Can Fin Homes Ltd | Equity | ₹58.22 Cr | 0.61% |

| Quess Corp Ltd | Equity | ₹57.85 Cr | 0.61% |

| Great Eastern Shipping Co Ltd | Equity | ₹57.17 Cr | 0.60% |

| Birlasoft Ltd | Equity | ₹56.67 Cr | 0.60% |

| Nuvama Wealth Management Ltd | Equity | ₹56.49 Cr | 0.59% |

| Repco Home Finance Ltd | Equity | ₹55.92 Cr | 0.59% |

| Strides Pharma Science Ltd | Equity | ₹55.13 Cr | 0.58% |

| Spicejet Ltd | Equity | ₹54.13 Cr | 0.57% |

| GE Vernova T&D India Ltd | Equity | ₹53.47 Cr | 0.56% |

| Computer Age Management Services Ltd Ordinary Shares | Equity | ₹53.34 Cr | 0.56% |

| Kewal Kiran Clothing Ltd | Equity | ₹50.74 Cr | 0.53% |

| Epigral Ltd | Equity | ₹48.95 Cr | 0.51% |

| Sansera Engineering Ltd | Equity | ₹48.88 Cr | 0.51% |

| Power Mech Projects Ltd | Equity | ₹48.7 Cr | 0.51% |

| Fedbank Financial Services Ltd | Equity | ₹48.61 Cr | 0.51% |

| Hi-Tech Pipes Ltd | Equity | ₹47.69 Cr | 0.50% |

| Aditya Birla Real Estate Ltd | Equity | ₹46.92 Cr | 0.49% |

| S H Kelkar & Co Ltd | Equity | ₹45.91 Cr | 0.48% |

| Punjab National Bank | Equity | ₹45.7 Cr | 0.48% |

| Blue Star Ltd | Equity | ₹45.32 Cr | 0.48% |

| NLC India Ltd | Equity | ₹44.56 Cr | 0.47% |

| Multi Commodity Exchange of India Ltd | Equity | ₹44.38 Cr | 0.47% |

| Baazar Style Retail Ltd | Equity | ₹43.99 Cr | 0.46% |

| Updater Services Ltd | Equity | ₹43.51 Cr | 0.46% |

| Sunteck Realty Ltd | Equity | ₹42.03 Cr | 0.44% |

| Senco Gold Ltd | Equity | ₹41.93 Cr | 0.44% |

| Ethos Ltd | Equity | ₹41.89 Cr | 0.44% |

| CESC Ltd | Equity | ₹41.66 Cr | 0.44% |

| Vishnu Chemicals Ltd | Equity | ₹40.66 Cr | 0.43% |

| PG Electroplast Ltd | Equity | ₹39.34 Cr | 0.41% |

| EFC (I) Ltd | Equity | ₹38.81 Cr | 0.41% |

| Triveni Engineering & Industries Ltd | Equity | ₹38.34 Cr | 0.40% |

| Reliance Industries Ltd | Equity | ₹37.74 Cr | 0.40% |

| Sapphire Foods India Ltd | Equity | ₹37.56 Cr | 0.39% |

| Krishna Institute of Medical Sciences Ltd | Equity | ₹36.82 Cr | 0.39% |

| Electronics Mart India Ltd | Equity | ₹36.32 Cr | 0.38% |

| Eternal Ltd | Equity | ₹36 Cr | 0.38% |

| Archean Chemical Industries Ltd | Equity | ₹35.53 Cr | 0.37% |

| Godrej Industries Ltd | Equity | ₹35.39 Cr | 0.37% |

| OneSource Specialty Pharma Ltd | Equity | ₹35.32 Cr | 0.37% |

| P N Gadgil Jewellers Ltd | Equity | ₹34.8 Cr | 0.37% |

| Tilaknagar Industries Ltd | Equity | ₹34.42 Cr | 0.36% |

| Medplus Health Services Ltd | Equity | ₹33.97 Cr | 0.36% |

| Jubilant Ingrevia Ltd Ordinary Shares | Equity | ₹33.82 Cr | 0.36% |

| Juniper Hotels Ltd | Equity | ₹33.8 Cr | 0.36% |

| Krsnaa Diagnostics Ltd | Equity | ₹33.63 Cr | 0.35% |

| Bombay Burmah Trading Corp Ltd | Equity | ₹32.95 Cr | 0.35% |

| RHI Magnesita India Ltd | Equity | ₹32.42 Cr | 0.34% |

| UPL Ltd | Equity | ₹31.93 Cr | 0.34% |

| Greenply Industries Ltd | Equity | ₹31.74 Cr | 0.33% |

| Eureka Forbes Ltd | Equity | ₹31.17 Cr | 0.33% |

| Bharat Dynamics Ltd Ordinary Shares | Equity | ₹31.03 Cr | 0.33% |

| National Aluminium Co Ltd | Equity | ₹29.66 Cr | 0.31% |

| Arvind SmartSpaces Ltd | Equity | ₹29.43 Cr | 0.31% |

| KEC International Ltd | Equity | ₹28.76 Cr | 0.30% |

| Samvardhana Motherson International Ltd | Equity | ₹28.31 Cr | 0.30% |

| Akums Drugs and Pharmaceuticals Ltd | Equity | ₹28.24 Cr | 0.30% |

| Jyothy Labs Ltd | Equity | ₹28.15 Cr | 0.30% |

| Cochin Shipyard Ltd | Equity | ₹27.93 Cr | 0.29% |

| Marksans Pharma Ltd | Equity | ₹27.66 Cr | 0.29% |

| Lumax Auto Technologies Ltd | Equity | ₹27.21 Cr | 0.29% |

| Brigade Enterprises Ltd | Equity | ₹26.37 Cr | 0.28% |

| Zee Entertainment Enterprises Ltd | Equity | ₹25.67 Cr | 0.27% |

| Torrent Power Ltd | Equity | ₹24.1 Cr | 0.25% |

| Emcure Pharmaceuticals Ltd | Equity | ₹24.02 Cr | 0.25% |

| Aditya Birla Sun Life AMC Ltd | Equity | ₹23.81 Cr | 0.25% |

| Indus Towers Ltd Ordinary Shares | Equity | ₹23.39 Cr | 0.25% |

| KFin Technologies Ltd | Equity | ₹23.12 Cr | 0.24% |

| Innova Captab Ltd | Equity | ₹23.02 Cr | 0.24% |

| Ecos (India) Mobility & Hospitality Ltd | Equity | ₹22.9 Cr | 0.24% |

| J.B. Chemicals & Pharmaceuticals Ltd | Equity | ₹22.8 Cr | 0.24% |

| GPT Healthcare Ltd | Equity | ₹22.34 Cr | 0.23% |

| Gulf Oil Lubricants India Ltd | Equity | ₹22.12 Cr | 0.23% |

| INOX Green Energy Services Ltd | Equity | ₹21.55 Cr | 0.23% |

| Satin Creditcare Network Ltd | Equity | ₹21.26 Cr | 0.22% |

| DCB Bank Ltd | Equity | ₹21.17 Cr | 0.22% |

| JK Lakshmi Cement Ltd | Equity | ₹21.14 Cr | 0.22% |

| Bansal Wire Industries Ltd | Equity | ₹20.67 Cr | 0.22% |

| Exide Industries Ltd | Equity | ₹20.62 Cr | 0.22% |

| Emami Ltd | Equity | ₹20.37 Cr | 0.21% |

| Ujjivan Small Finance Bank Ltd Ordinary Shares | Equity | ₹20.33 Cr | 0.21% |

| AstraZeneca Pharma India Ltd | Equity | ₹20.31 Cr | 0.21% |

| Alicon Castalloy Ltd | Equity | ₹20.17 Cr | 0.21% |

| Concord Enviro Systems Ltd | Equity | ₹19.68 Cr | 0.21% |

| Affle India Ltd | Equity | ₹19.68 Cr | 0.21% |

| Bharat Forge Ltd | Equity | ₹19.3 Cr | 0.20% |

| Kaynes Technology India Ltd | Equity | ₹19.14 Cr | 0.20% |

| Sterlite Technologies Ltd | Equity | ₹19.09 Cr | 0.20% |

| Crompton Greaves Consumer Electricals Ltd | Equity | ₹18.96 Cr | 0.20% |

| Bank of India | Equity | ₹18.65 Cr | 0.20% |

| Keystone Realtors Ltd | Equity | ₹18.5 Cr | 0.19% |

| Rane Holdings Ltd | Equity | ₹18.48 Cr | 0.19% |

| 360 One Wam Ltd Ordinary Shares | Equity | ₹18.47 Cr | 0.19% |

| GMM Pfaudler Ltd | Equity | ₹18.41 Cr | 0.19% |

| Apeejay Surrendra Park Hotels Ltd | Equity | ₹17.87 Cr | 0.19% |

| Garware Hi-Tech Films Ltd | Equity | ₹17.72 Cr | 0.19% |

| FDC Ltd | Equity | ₹17.58 Cr | 0.18% |

| IndiaMART InterMESH Ltd | Equity | ₹17.17 Cr | 0.18% |

| Greenpanel Industries Ltd Ordinary Shares | Equity | ₹16.99 Cr | 0.18% |

| Net Current Assets | Cash | ₹-16.95 Cr | 0.18% |

| VRL Logistics Ltd | Equity | ₹16.33 Cr | 0.17% |

| Steel Strips Wheels Ltd | Equity | ₹15.81 Cr | 0.17% |

| Heritage Foods Ltd | Equity | ₹15.79 Cr | 0.17% |

| Craftsman Automation Ltd | Equity | ₹15.71 Cr | 0.17% |

| Artemis Medicare Services Ltd Ordinary Shares | Equity | ₹15.49 Cr | 0.16% |

| Orchid Pharma Ltd | Equity | ₹13.49 Cr | 0.14% |

| Amber Enterprises India Ltd Ordinary Shares | Equity | ₹13.17 Cr | 0.14% |

| Mayur Uniquoters Ltd | Equity | ₹13.01 Cr | 0.14% |

| Star Health and Allied Insurance Co Ltd | Equity | ₹12.87 Cr | 0.14% |

| Mastek Ltd | Equity | ₹12 Cr | 0.13% |

| TBO Tek Ltd | Equity | ₹11.88 Cr | 0.12% |

| Chemplast Sanmar Ltd | Equity | ₹11.64 Cr | 0.12% |

| CE Info Systems Ltd | Equity | ₹10.96 Cr | 0.12% |

| IRM Energy Ltd | Equity | ₹10.64 Cr | 0.11% |

| Yatra Online Ltd | Equity | ₹9.52 Cr | 0.10% |

| MOIL Ltd | Equity | ₹8.98 Cr | 0.09% |

| Vintage Coffee & Beverages Ltd | Equity | ₹8.89 Cr | 0.09% |

| Gujarat State Petronet Ltd | Equity | ₹8.62 Cr | 0.09% |

| Landmark Cars Ltd | Equity | ₹8.13 Cr | 0.09% |

| Metropolis Healthcare Ltd | Equity | ₹7.49 Cr | 0.08% |

| Laxmi Dental Ltd | Equity | ₹7.16 Cr | 0.08% |

| JK Tyre & Industries Ltd | Equity | ₹6.83 Cr | 0.07% |

| Arvind Fashions Ltd | Equity | ₹6.35 Cr | 0.07% |

| Orient Cement Ltd | Equity | ₹6.31 Cr | 0.07% |

| Unimech Aerospace And Manufacturing Ltd | Equity | ₹6.16 Cr | 0.06% |

| Cash Margin - Ccil | Cash - Repurchase Agreement | ₹5.64 Cr | 0.06% |

| Godavari Biorefineries Ltd | Equity | ₹5.18 Cr | 0.05% |

| KRN Heat Exchanger and Refrigeration Ltd | Equity | ₹5.08 Cr | 0.05% |

| UPL Ltd Ordinary Shares (Partly Paid Rs.1) | Equity | ₹4.35 Cr | 0.05% |

| Dam Capital Advisors Ltd | Equity | ₹4.19 Cr | 0.04% |

| GNA Axles Ltd | Equity | ₹4.04 Cr | 0.04% |

| Rishabh Instruments Ltd | Equity | ₹3.83 Cr | 0.04% |

| Butterfly Gandhimathi Appliances Ltd | Equity | ₹2.87 Cr | 0.03% |

| PTC India Ltd | Equity | ₹2.83 Cr | 0.03% |

| Religare Enterprises Ltd | Equity | ₹2.25 Cr | 0.02% |

| Sai Life Sciences Ltd | Equity | ₹1.97 Cr | 0.02% |

| Thangamayil Jewellery Ltd | Equity | ₹0.67 Cr | 0.01% |

| Zensar Technologies Ltd | Equity | ₹0.47 Cr | 0.00% |

Allocation By Market Cap (Equity)

Large Cap Stocks

5.36%

Mid Cap Stocks

10.30%

Small Cap Stocks

72.50%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Financial Services | ₹1,688.14 Cr | 17.74% |

| Industrials | ₹1,352.5 Cr | 14.21% |

| Consumer Cyclical | ₹1,202.67 Cr | 12.64% |

| Healthcare | ₹1,148.85 Cr | 12.07% |

| Basic Materials | ₹1,115.34 Cr | 11.72% |

| Real Estate | ₹731.61 Cr | 7.69% |

| Consumer Defensive | ₹489.32 Cr | 5.14% |

| Technology | ₹406.38 Cr | 4.27% |

| Utilities | ₹173.65 Cr | 1.82% |

| Communication Services | ₹85.91 Cr | 0.90% |

| Energy | ₹37.74 Cr | 0.40% |

Risk & Performance Ratios

Standard Deviation

This fund

18.43%

Cat. avg.

17.43%

Lower the better

Sharpe Ratio

This fund

1.00

Cat. avg.

0.64

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.01

Higher the better

Fund Managers

Manish Gunwani

Since January 2023

Kirthi Jain

Since June 2023

Ritika Behera

Since October 2023

Gaurav Satra

Since June 2024

Additional Scheme Detailsas of 31st March 2025

ISIN INF194KB1AL4 | Expense Ratio 0.50% | Exit Load 1.00% | Fund Size ₹9,516 Cr | Age 5 years 1 month | Lumpsum Minimum ₹1,000 | Fund Status Open Ended Investment Company | Benchmark BSE 250 SmallCap TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Small-Cap Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Mirae Asset Small Cap Fund Regular Growth Very High Risk | 2.1% | 1.0% | ₹1263.28 Cr | - |

| Mirae Asset Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1263.28 Cr | - |

| TrustMF Small Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹817.25 Cr | - |

| TrustMF Small Cap Fund Regular Growth Very High Risk | 2.2% | 1.0% | ₹817.25 Cr | - |

| JM Small Cap Fund Regular Growth Very High Risk | 2.3% | 1.0% | ₹594.06 Cr | - |

| JM Small Cap Fund Direct Growth Very High Risk | 0.7% | 1.0% | ₹594.06 Cr | - |

| Motilal Oswal Nifty Smallcap 250 ETF Very High Risk | 0.3% | - | ₹84.94 Cr | 1.6% |

| Motilal Oswal Small Cap Fund Regular Growth Very High Risk | 1.8% | 1.0% | ₹4166.58 Cr | 17.4% |

| Motilal Oswal Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹4166.58 Cr | 19.1% |

| Quantum Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹108.01 Cr | 6.8% |

About the AMC

Bandhan Mutual Fund

Total AUM

₹1,60,392 Cr

Address

6th Floor, 841, One World Center, Mumbai, 400013

Other Funds by Bandhan Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of Bandhan Emerging Businesses Fund Direct Growth?

What are the returns of Bandhan Emerging Businesses Fund Direct Growth?

What is the portfolio composition of Bandhan Emerging Businesses Fund Direct Growth?

Who manages the Bandhan Emerging Businesses Fund Direct Growth?

- Manish Gunwani

- Kirthi Jain

- Ritika Behera

- Gaurav Satra

NAV (17-Apr-25)

Returns (Since Inception)

Fund Overview

Fund Size

₹9,516 Cr

Expense Ratio

0.50%

ISIN

INF194KB1AL4

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

26 Feb 2020

Risk Level

Your principal amount will be at Very High Risk

About this fund

As of 17-Apr-25, it has a Net Asset Value (NAV) of ₹45.59, Assets Under Management (AUM) of 9516.16 Crores, and an expense ratio of 0.5%.

- Bandhan Emerging Businesses Fund Direct Growth has given a CAGR return of 34.34% since inception.

- The fund's asset allocation comprises around 89.26% in equities, 0.00% in debts, and 10.74% in cash & cash equivalents.

- You can start investing in Bandhan Emerging Businesses Fund Direct Growth with a SIP of ₹1000 or a Lumpsum investment of ₹1000.

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+17.60%

+5.80% (Cat Avg.)

3 Years

+26.52%

+17.11% (Cat Avg.)

5 Years

+37.40%

+33.84% (Cat Avg.)

Since Inception

+34.34%

— (Cat Avg.)

Portfolio Summaryas of 31st March 2025

| Equity | ₹8,493.87 Cr | 89.26% |

| Others | ₹1,022.29 Cr | 10.74% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Triparty Repo Trp_020425 | Cash - Repurchase Agreement | ₹1,033.6 Cr | 10.86% |

| Sobha Ltd | Equity | ₹264.78 Cr | 2.78% |

| LT Foods Ltd | Equity | ₹251.4 Cr | 2.64% |

| PCBL Chemical Ltd | Equity | ₹220.02 Cr | 2.31% |

| The South Indian Bank Ltd | Equity | ₹210.5 Cr | 2.21% |

| Cholamandalam Financial Holdings Ltd | Equity | ₹206.4 Cr | 2.17% |

| Arvind Ltd | Equity | ₹156.88 Cr | 1.65% |

| Shaily Engineering Plastics Ltd | Equity | ₹151.07 Cr | 1.59% |

| Yatharth Hospital and Trauma Care Services Ltd | Equity | ₹138.04 Cr | 1.45% |

| Karnataka Bank Ltd | Equity | ₹120.25 Cr | 1.26% |

| Apar Industries Ltd | Equity | ₹116.76 Cr | 1.23% |

| REC Ltd | Equity | ₹114.55 Cr | 1.20% |

| Manappuram Finance Ltd | Equity | ₹111.24 Cr | 1.17% |

| Inox Wind Energy Ltd Ordinary Shares | Equity | ₹110.93 Cr | 1.17% |

| Glenmark Pharmaceuticals Ltd | Equity | ₹103.77 Cr | 1.09% |

| TVS Holdings Ltd | Equity | ₹103.73 Cr | 1.09% |

| Rashi Peripherals Ltd | Equity | ₹99.52 Cr | 1.05% |

| Nitin Spinners Ltd | Equity | ₹92.12 Cr | 0.97% |

| Power Finance Corp Ltd | Equity | ₹91.11 Cr | 0.96% |

| IndusInd Bank Ltd | Equity | ₹89.17 Cr | 0.94% |

| Kirloskar Oil Engines Ltd | Equity | ₹88.56 Cr | 0.93% |

| Prestige Estates Projects Ltd | Equity | ₹87.58 Cr | 0.92% |

| Motilal Oswal Financial Services Ltd | Equity | ₹83.72 Cr | 0.88% |

| Sanathan Textiles Ltd | Equity | ₹83.1 Cr | 0.87% |

| eClerx Services Ltd | Equity | ₹82.96 Cr | 0.87% |

| Cyient Ltd | Equity | ₹81.72 Cr | 0.86% |

| PNB Housing Finance Ltd | Equity | ₹80.43 Cr | 0.85% |

| Shilpa Medicare Ltd | Equity | ₹78.36 Cr | 0.82% |

| Jupiter Wagons Ltd | Equity | ₹77.82 Cr | 0.82% |

| Godawari Power & Ispat Ltd | Equity | ₹77.03 Cr | 0.81% |

| Kolte-Patil Developers Ltd | Equity | ₹76.29 Cr | 0.80% |

| Aurobindo Pharma Ltd | Equity | ₹75.48 Cr | 0.79% |

| Vedanta Ltd | Equity | ₹74.4 Cr | 0.78% |

| TARC Ltd Ordinary Shares | Equity | ₹74.06 Cr | 0.78% |

| Signatureglobal (India) Ltd | Equity | ₹73.76 Cr | 0.78% |

| Wockhardt Ltd | Equity | ₹71.85 Cr | 0.75% |

| Stove Kraft Ltd Ordinary Shares | Equity | ₹71.02 Cr | 0.75% |

| Angel One Ltd Ordinary Shares | Equity | ₹69.47 Cr | 0.73% |

| Amara Raja Energy & Mobility Ltd | Equity | ₹65.92 Cr | 0.69% |

| Aster DM Healthcare Ltd Ordinary Shares | Equity | ₹65.47 Cr | 0.69% |

| Eris Lifesciences Ltd Registered Shs | Equity | ₹65.08 Cr | 0.68% |

| Deepak Fertilisers & Petrochemicals Corp Ltd | Equity | ₹64.92 Cr | 0.68% |

| Inox Wind Ltd | Equity | ₹64.81 Cr | 0.68% |

| NCC Ltd | Equity | ₹64.41 Cr | 0.68% |

| Piramal Pharma Ltd | Equity | ₹63.36 Cr | 0.67% |

| Kirloskar Ferrous Industries Ltd | Equity | ₹62.78 Cr | 0.66% |

| Neuland Laboratories Limited | Equity | ₹61.76 Cr | 0.65% |

| Jubilant Pharmova Ltd | Equity | ₹61 Cr | 0.64% |

| Radico Khaitan Ltd | Equity | ₹59 Cr | 0.62% |

| Bank of Baroda | Equity | ₹58.95 Cr | 0.62% |

| Can Fin Homes Ltd | Equity | ₹58.22 Cr | 0.61% |

| Quess Corp Ltd | Equity | ₹57.85 Cr | 0.61% |

| Great Eastern Shipping Co Ltd | Equity | ₹57.17 Cr | 0.60% |

| Birlasoft Ltd | Equity | ₹56.67 Cr | 0.60% |

| Nuvama Wealth Management Ltd | Equity | ₹56.49 Cr | 0.59% |

| Repco Home Finance Ltd | Equity | ₹55.92 Cr | 0.59% |

| Strides Pharma Science Ltd | Equity | ₹55.13 Cr | 0.58% |

| Spicejet Ltd | Equity | ₹54.13 Cr | 0.57% |

| GE Vernova T&D India Ltd | Equity | ₹53.47 Cr | 0.56% |

| Computer Age Management Services Ltd Ordinary Shares | Equity | ₹53.34 Cr | 0.56% |

| Kewal Kiran Clothing Ltd | Equity | ₹50.74 Cr | 0.53% |

| Epigral Ltd | Equity | ₹48.95 Cr | 0.51% |

| Sansera Engineering Ltd | Equity | ₹48.88 Cr | 0.51% |

| Power Mech Projects Ltd | Equity | ₹48.7 Cr | 0.51% |

| Fedbank Financial Services Ltd | Equity | ₹48.61 Cr | 0.51% |

| Hi-Tech Pipes Ltd | Equity | ₹47.69 Cr | 0.50% |

| Aditya Birla Real Estate Ltd | Equity | ₹46.92 Cr | 0.49% |

| S H Kelkar & Co Ltd | Equity | ₹45.91 Cr | 0.48% |

| Punjab National Bank | Equity | ₹45.7 Cr | 0.48% |

| Blue Star Ltd | Equity | ₹45.32 Cr | 0.48% |

| NLC India Ltd | Equity | ₹44.56 Cr | 0.47% |

| Multi Commodity Exchange of India Ltd | Equity | ₹44.38 Cr | 0.47% |

| Baazar Style Retail Ltd | Equity | ₹43.99 Cr | 0.46% |

| Updater Services Ltd | Equity | ₹43.51 Cr | 0.46% |

| Sunteck Realty Ltd | Equity | ₹42.03 Cr | 0.44% |

| Senco Gold Ltd | Equity | ₹41.93 Cr | 0.44% |

| Ethos Ltd | Equity | ₹41.89 Cr | 0.44% |

| CESC Ltd | Equity | ₹41.66 Cr | 0.44% |

| Vishnu Chemicals Ltd | Equity | ₹40.66 Cr | 0.43% |

| PG Electroplast Ltd | Equity | ₹39.34 Cr | 0.41% |

| EFC (I) Ltd | Equity | ₹38.81 Cr | 0.41% |

| Triveni Engineering & Industries Ltd | Equity | ₹38.34 Cr | 0.40% |

| Reliance Industries Ltd | Equity | ₹37.74 Cr | 0.40% |

| Sapphire Foods India Ltd | Equity | ₹37.56 Cr | 0.39% |

| Krishna Institute of Medical Sciences Ltd | Equity | ₹36.82 Cr | 0.39% |

| Electronics Mart India Ltd | Equity | ₹36.32 Cr | 0.38% |

| Eternal Ltd | Equity | ₹36 Cr | 0.38% |

| Archean Chemical Industries Ltd | Equity | ₹35.53 Cr | 0.37% |

| Godrej Industries Ltd | Equity | ₹35.39 Cr | 0.37% |

| OneSource Specialty Pharma Ltd | Equity | ₹35.32 Cr | 0.37% |

| P N Gadgil Jewellers Ltd | Equity | ₹34.8 Cr | 0.37% |

| Tilaknagar Industries Ltd | Equity | ₹34.42 Cr | 0.36% |

| Medplus Health Services Ltd | Equity | ₹33.97 Cr | 0.36% |

| Jubilant Ingrevia Ltd Ordinary Shares | Equity | ₹33.82 Cr | 0.36% |

| Juniper Hotels Ltd | Equity | ₹33.8 Cr | 0.36% |

| Krsnaa Diagnostics Ltd | Equity | ₹33.63 Cr | 0.35% |

| Bombay Burmah Trading Corp Ltd | Equity | ₹32.95 Cr | 0.35% |

| RHI Magnesita India Ltd | Equity | ₹32.42 Cr | 0.34% |

| UPL Ltd | Equity | ₹31.93 Cr | 0.34% |

| Greenply Industries Ltd | Equity | ₹31.74 Cr | 0.33% |

| Eureka Forbes Ltd | Equity | ₹31.17 Cr | 0.33% |

| Bharat Dynamics Ltd Ordinary Shares | Equity | ₹31.03 Cr | 0.33% |

| National Aluminium Co Ltd | Equity | ₹29.66 Cr | 0.31% |

| Arvind SmartSpaces Ltd | Equity | ₹29.43 Cr | 0.31% |

| KEC International Ltd | Equity | ₹28.76 Cr | 0.30% |

| Samvardhana Motherson International Ltd | Equity | ₹28.31 Cr | 0.30% |

| Akums Drugs and Pharmaceuticals Ltd | Equity | ₹28.24 Cr | 0.30% |

| Jyothy Labs Ltd | Equity | ₹28.15 Cr | 0.30% |

| Cochin Shipyard Ltd | Equity | ₹27.93 Cr | 0.29% |

| Marksans Pharma Ltd | Equity | ₹27.66 Cr | 0.29% |

| Lumax Auto Technologies Ltd | Equity | ₹27.21 Cr | 0.29% |

| Brigade Enterprises Ltd | Equity | ₹26.37 Cr | 0.28% |

| Zee Entertainment Enterprises Ltd | Equity | ₹25.67 Cr | 0.27% |

| Torrent Power Ltd | Equity | ₹24.1 Cr | 0.25% |

| Emcure Pharmaceuticals Ltd | Equity | ₹24.02 Cr | 0.25% |

| Aditya Birla Sun Life AMC Ltd | Equity | ₹23.81 Cr | 0.25% |

| Indus Towers Ltd Ordinary Shares | Equity | ₹23.39 Cr | 0.25% |

| KFin Technologies Ltd | Equity | ₹23.12 Cr | 0.24% |

| Innova Captab Ltd | Equity | ₹23.02 Cr | 0.24% |

| Ecos (India) Mobility & Hospitality Ltd | Equity | ₹22.9 Cr | 0.24% |

| J.B. Chemicals & Pharmaceuticals Ltd | Equity | ₹22.8 Cr | 0.24% |

| GPT Healthcare Ltd | Equity | ₹22.34 Cr | 0.23% |

| Gulf Oil Lubricants India Ltd | Equity | ₹22.12 Cr | 0.23% |

| INOX Green Energy Services Ltd | Equity | ₹21.55 Cr | 0.23% |

| Satin Creditcare Network Ltd | Equity | ₹21.26 Cr | 0.22% |

| DCB Bank Ltd | Equity | ₹21.17 Cr | 0.22% |

| JK Lakshmi Cement Ltd | Equity | ₹21.14 Cr | 0.22% |

| Bansal Wire Industries Ltd | Equity | ₹20.67 Cr | 0.22% |

| Exide Industries Ltd | Equity | ₹20.62 Cr | 0.22% |

| Emami Ltd | Equity | ₹20.37 Cr | 0.21% |

| Ujjivan Small Finance Bank Ltd Ordinary Shares | Equity | ₹20.33 Cr | 0.21% |

| AstraZeneca Pharma India Ltd | Equity | ₹20.31 Cr | 0.21% |

| Alicon Castalloy Ltd | Equity | ₹20.17 Cr | 0.21% |

| Concord Enviro Systems Ltd | Equity | ₹19.68 Cr | 0.21% |

| Affle India Ltd | Equity | ₹19.68 Cr | 0.21% |

| Bharat Forge Ltd | Equity | ₹19.3 Cr | 0.20% |

| Kaynes Technology India Ltd | Equity | ₹19.14 Cr | 0.20% |

| Sterlite Technologies Ltd | Equity | ₹19.09 Cr | 0.20% |

| Crompton Greaves Consumer Electricals Ltd | Equity | ₹18.96 Cr | 0.20% |

| Bank of India | Equity | ₹18.65 Cr | 0.20% |

| Keystone Realtors Ltd | Equity | ₹18.5 Cr | 0.19% |

| Rane Holdings Ltd | Equity | ₹18.48 Cr | 0.19% |

| 360 One Wam Ltd Ordinary Shares | Equity | ₹18.47 Cr | 0.19% |

| GMM Pfaudler Ltd | Equity | ₹18.41 Cr | 0.19% |

| Apeejay Surrendra Park Hotels Ltd | Equity | ₹17.87 Cr | 0.19% |

| Garware Hi-Tech Films Ltd | Equity | ₹17.72 Cr | 0.19% |

| FDC Ltd | Equity | ₹17.58 Cr | 0.18% |

| IndiaMART InterMESH Ltd | Equity | ₹17.17 Cr | 0.18% |

| Greenpanel Industries Ltd Ordinary Shares | Equity | ₹16.99 Cr | 0.18% |

| Net Current Assets | Cash | ₹-16.95 Cr | 0.18% |

| VRL Logistics Ltd | Equity | ₹16.33 Cr | 0.17% |

| Steel Strips Wheels Ltd | Equity | ₹15.81 Cr | 0.17% |

| Heritage Foods Ltd | Equity | ₹15.79 Cr | 0.17% |

| Craftsman Automation Ltd | Equity | ₹15.71 Cr | 0.17% |

| Artemis Medicare Services Ltd Ordinary Shares | Equity | ₹15.49 Cr | 0.16% |

| Orchid Pharma Ltd | Equity | ₹13.49 Cr | 0.14% |

| Amber Enterprises India Ltd Ordinary Shares | Equity | ₹13.17 Cr | 0.14% |

| Mayur Uniquoters Ltd | Equity | ₹13.01 Cr | 0.14% |

| Star Health and Allied Insurance Co Ltd | Equity | ₹12.87 Cr | 0.14% |

| Mastek Ltd | Equity | ₹12 Cr | 0.13% |

| TBO Tek Ltd | Equity | ₹11.88 Cr | 0.12% |

| Chemplast Sanmar Ltd | Equity | ₹11.64 Cr | 0.12% |

| CE Info Systems Ltd | Equity | ₹10.96 Cr | 0.12% |

| IRM Energy Ltd | Equity | ₹10.64 Cr | 0.11% |

| Yatra Online Ltd | Equity | ₹9.52 Cr | 0.10% |

| MOIL Ltd | Equity | ₹8.98 Cr | 0.09% |

| Vintage Coffee & Beverages Ltd | Equity | ₹8.89 Cr | 0.09% |

| Gujarat State Petronet Ltd | Equity | ₹8.62 Cr | 0.09% |

| Landmark Cars Ltd | Equity | ₹8.13 Cr | 0.09% |

| Metropolis Healthcare Ltd | Equity | ₹7.49 Cr | 0.08% |

| Laxmi Dental Ltd | Equity | ₹7.16 Cr | 0.08% |

| JK Tyre & Industries Ltd | Equity | ₹6.83 Cr | 0.07% |

| Arvind Fashions Ltd | Equity | ₹6.35 Cr | 0.07% |

| Orient Cement Ltd | Equity | ₹6.31 Cr | 0.07% |

| Unimech Aerospace And Manufacturing Ltd | Equity | ₹6.16 Cr | 0.06% |

| Cash Margin - Ccil | Cash - Repurchase Agreement | ₹5.64 Cr | 0.06% |

| Godavari Biorefineries Ltd | Equity | ₹5.18 Cr | 0.05% |

| KRN Heat Exchanger and Refrigeration Ltd | Equity | ₹5.08 Cr | 0.05% |

| UPL Ltd Ordinary Shares (Partly Paid Rs.1) | Equity | ₹4.35 Cr | 0.05% |

| Dam Capital Advisors Ltd | Equity | ₹4.19 Cr | 0.04% |

| GNA Axles Ltd | Equity | ₹4.04 Cr | 0.04% |

| Rishabh Instruments Ltd | Equity | ₹3.83 Cr | 0.04% |

| Butterfly Gandhimathi Appliances Ltd | Equity | ₹2.87 Cr | 0.03% |

| PTC India Ltd | Equity | ₹2.83 Cr | 0.03% |

| Religare Enterprises Ltd | Equity | ₹2.25 Cr | 0.02% |

| Sai Life Sciences Ltd | Equity | ₹1.97 Cr | 0.02% |

| Thangamayil Jewellery Ltd | Equity | ₹0.67 Cr | 0.01% |

| Zensar Technologies Ltd | Equity | ₹0.47 Cr | 0.00% |

Allocation By Market Cap (Equity)

Large Cap Stocks

5.36%

Mid Cap Stocks

10.30%

Small Cap Stocks

72.50%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Financial Services | ₹1,688.14 Cr | 17.74% |

| Industrials | ₹1,352.5 Cr | 14.21% |

| Consumer Cyclical | ₹1,202.67 Cr | 12.64% |

| Healthcare | ₹1,148.85 Cr | 12.07% |

| Basic Materials | ₹1,115.34 Cr | 11.72% |

| Real Estate | ₹731.61 Cr | 7.69% |

| Consumer Defensive | ₹489.32 Cr | 5.14% |

| Technology | ₹406.38 Cr | 4.27% |

| Utilities | ₹173.65 Cr | 1.82% |

| Communication Services | ₹85.91 Cr | 0.90% |

| Energy | ₹37.74 Cr | 0.40% |

Risk & Performance Ratios

Standard Deviation

This fund

18.43%

Cat. avg.

17.43%

Lower the better

Sharpe Ratio

This fund

1.00

Cat. avg.

0.64

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.01

Higher the better

Fund Managers

Manish Gunwani

Since January 2023

Kirthi Jain

Since June 2023

Ritika Behera

Since October 2023

Gaurav Satra

Since June 2024

Additional Scheme Detailsas of 31st March 2025

ISIN INF194KB1AL4 | Expense Ratio 0.50% | Exit Load 1.00% | Fund Size ₹9,516 Cr | Age 5 years 1 month | Lumpsum Minimum ₹1,000 | Fund Status Open Ended Investment Company | Benchmark BSE 250 SmallCap TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Small-Cap Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Mirae Asset Small Cap Fund Regular Growth Very High Risk | 2.1% | 1.0% | ₹1263.28 Cr | - |

| Mirae Asset Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1263.28 Cr | - |

| TrustMF Small Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹817.25 Cr | - |

| TrustMF Small Cap Fund Regular Growth Very High Risk | 2.2% | 1.0% | ₹817.25 Cr | - |

| JM Small Cap Fund Regular Growth Very High Risk | 2.3% | 1.0% | ₹594.06 Cr | - |

| JM Small Cap Fund Direct Growth Very High Risk | 0.7% | 1.0% | ₹594.06 Cr | - |

| Motilal Oswal Nifty Smallcap 250 ETF Very High Risk | 0.3% | - | ₹84.94 Cr | 1.6% |

| Motilal Oswal Small Cap Fund Regular Growth Very High Risk | 1.8% | 1.0% | ₹4166.58 Cr | 17.4% |

| Motilal Oswal Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹4166.58 Cr | 19.1% |

| Quantum Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹108.01 Cr | 6.8% |

About the AMC

Bandhan Mutual Fund

Total AUM

₹1,60,392 Cr

Address

6th Floor, 841, One World Center, Mumbai, 400013

Other Funds by Bandhan Mutual Fund

Still got questions?

We're here to help.

What is the current NAV of Bandhan Emerging Businesses Fund Direct Growth?

What are the returns of Bandhan Emerging Businesses Fund Direct Growth?

What is the portfolio composition of Bandhan Emerging Businesses Fund Direct Growth?

Who manages the Bandhan Emerging Businesses Fund Direct Growth?

- Manish Gunwani

- Kirthi Jain

- Ritika Behera

- Gaurav Satra

Get your portfolio reviewed by experts